Everyone is dreaming about it. Everyone wants it. When I hear the words “Financial Freedom”, my mind starts to go to some places of my dreams until It comes back home to realize that achieving financial freedom in Germany is not easy. The most of the books I’ve read so far are written by authors from the United States. Actually it is easier to achieve financial freedom in the US than in Germany.

With this post I want to give all German people the hope that also we can achieve financial freedom. Not everyone will make it. But even if you just start with your money journey, it will lead to a higher financial security in your life. And with a higher financial security, you will be less stressed and be less afraid of unexpected expenses. I want to share with all of you my plan towards my goal – Financial Freedom in Germany.

1. Make A List Of Your Fix Income(s) & Expenses

The very first step in the way to financial freedom is to be aware of your income and your fix expenses. It can hurt a lot if you see what you have available if you subtract the income vs. expenses. But it can also give you a good feeling. Wherever you are standing right now, just keep it for you. Nobody needs to know. The most important part is, that you are willing to change your current situation. And to change the current situation, you have to get (back) the control of your money.

Do It With Your Hands

I do recommend to list your income and expenses on a piece of paper with your hands. Yes, with your hands. Studies show that writing notes with your hands will help you to remember the content better than if you use a computer or a similar device. Whatever method you will use, make sure you remember it. You could put it on your fridge or closet to see it every day.

So how do you start? First of all, download your expenses of the last 3 months. You can do it by using your online banking or your actually go to a statement printer in one of your bank branches. Also make sure that you don’t forget your expenses, which will be written off by the quarter or by the year.

On the piece of paper create a table with three columns. You can name them “Income”, “Expenses” and “Notes”. Now you can put in the numbers for your monthly income & expenses. In the example below I’ve calculated the expenses for the quarter by dividing the amount by 3 (Car Insurance) and the yearly amount by 12 (Car Tax). In my example you can’t find the row for the groceries or the gas for the car. I did not implement them to simplify it, but I do suggest to put there the average amount. You could track your spendings on those categories for a month or two and create the average.

| Income € | Expenses € | Notes |

|---|---|---|

| 2000 | ||

| 900 | Rent | |

| 50 | Electricity (Strom) | |

| 25 | Phone & Internet | |

| 18 | TV License (GEZ) | |

| 25 | Mobile Phone | |

| 10 | Netflix | |

| 10 | Spotify | |

| 60 | Car Insurance | |

| 20 | Car Tax | |

| 50 | Paying Off Credit | |

| Total | Total | Difference |

| 2000 | 1168 | +832 |

Sometimes it might be hard to see the truth for your situation, but to get the control of your money, it is an important step to understand your spending habits and to see how much money you have left after your expenses are subtracted from your income.

2. Analyze Your Expenses

Once you have calculated the difference between your income and your expenses you will see the situation a little more clear. Despite if your number is positive or negative. In any case, you should take the time and the next step to analyze all of your expenses. The idea behind this step is to decrease your expenses month by month to the most possible minimum. Sometimes there might be no other way, but always be creative in finding solutions. Here are some of my tips:

- The German Banks are more and more introducing a monthly fee for the bank account. Let’s say, your bank ask for an activity charge of 10 Euro per month. That’s insane. There are so many banks out there who will be happy to get a new customer and provide you with a bank account for free. I do personally like the offers at DKB and I am a very happy customer.

- Another idea to save a few euros per month is to share your Netflix or Spotify account with your family or friends. It will be a win-win situation.

- Many companies offer you a cheaper price if you set your payment method from a monthly payment to a yearly one. Sometimes the offers are really useful and from your monthly perspective you can save a few euros with that easy step.

If you have some more and creative ideas, feel free to post them in the comment section and I will add them to the list above. Again for the record. The sense of this step is to reduce your expenses to the minimum.

3. Get Out Of Debt

I could have added that step to the ideas to reduce your monthly expenses, but it is too important to make a clear statement.

GET OUT OF DEBT AS SOON AS YOU CAN!

I know. It is easier said than done. I was there and to be honest I’ve felt awful in that time. I’ve felt so awful, I put all my effort and strength into it to get out of it in the fastest way possible.

I know that the offers can be charming. For example, paying off your new TV within 24 months just with 50 Euro a month. I cannot tell you what to do, but I do recommend to buy your stuff only when you saved enough to pay it off at once.

4. Automate Your Finances

With the following step, our target is to create an automatic money flow with your existing accounts to avoid any manual intervention every month. This step is is not to “set and forget”. It is more a way to always pay yourself first and make sure you don’t forget anything. It is very important for your journey to achieve financial freedom in Germany.

With “pay yourself first”, I mean to save and invest an amount (which is for your freedom) automatically and pay your liabilities with the available amount you have left afterwards. With an automatic money flow, you can be sure that this is taken care for you every month.

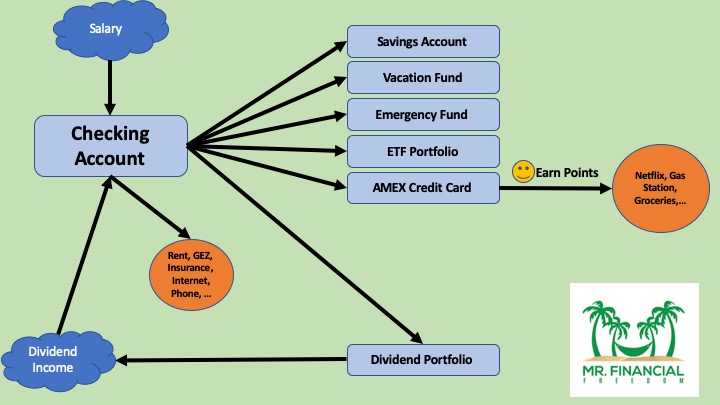

I’ve created my personal Mr. Financial Freedom Automatic Money Flow. It should give you an idea on how your money flow could look like.

Mr. Financial Freedom Automatic Money Flow

Let me explain some of the parts in my picture.

Savings Account: I put about 5 % of my income in an extra savings account at my DKB bank account. This money is not accessible for me for about 5 years and the purpose of that savings account is long-term. I have set up an automatic saving plan for a future wedding and for a house.

Vacation Fund: I put there about 5% of my income in a dedicated account. I call it Vacation Fund. That money will only be used for travels.

Emergency Fund: It is important to have an Emergency Fund which is accessible at any time. Check out Why you need an Emergency Fund? I put there also about 5% of my income per month.

AMEX Credit Card: I use my American Express Credit Card to pay for services like Netflix or use the card for paying at the grocery store. It gives me the opportunity to collect points which I can re-use for travels.

ETF & Dividend Portfolio: In the next step I will talk about how I am investing my money and why you should invest as well.

5. Invest Your Money

Investing your money is the most important step to achieve financial freedom in Germany. A traditional saving account only provide a very low yield and it is not enough in the long-term. The most people who reached financial independence and retired early, invested their money in the stock market, because it offers a good annual return, if you invest it in the right way.

There are many good strategies to invest in the stock market. I am focusing on two strategies in this article, like investing in individual dividend stocks and in an Exchange Traded Fund (ETF).

An ETF is tracking an index and it is easy to invest in. There is no real effort from your side needed. Currently I am investing in one low-fee ETF:

– Vanguard FTSE All-World UCITS ETF (USD) Accumulating

This ETF has a TER of 0,22%, has a good size and in my opinion also a good allocation.

If you invest your money in individual dividend stocks, the effort is quite high, because you have to analyze all the companies in detail to understand where your money is properly invested. I am investing my money using both strategies. Here is my current Stock Portfolio. Keep in mind that those are my decisions where I put my money. It is not a guarantee and you should make your own analysis and decisions.

There are many other ways out there. Just to mention a few like Real Estate, Crowdfunding or Startup investing.

6. Optimize & Stay Motivated

Optimization is crucial. Not everything will be perfect and not everything will make you feel comfortable. So it is out of your comfort zone.

The 5 steps mentioned in this post have to be reviewed frequently and if you find ways to optimize it, do it!

Follow your goal to achieve financial freedom in Germany and stay motivated! I am staying motivated by reading a lot of financial books of people who already achieved financial freedom. Check out my stuff-i-love page to see my recommended books.

Mr. Financial Freedom

Latest posts by Mr. Financial Freedom (see all)

- The 24 Days of Wealthy Wonders 🎄 - December 2, 2024

- 7 Years of Dividend Investing: My Journey, Lessons, and Future Goals - November 17, 2024

- Should You Have A Shared Account With Your Partner? - June 16, 2022

- Do You Need 1 Million To Retire? - June 15, 2022

- My First Experience With Options Trading - October 29, 2020