Introduction: Reflecting on 7 Years of Dividend Investing

It is almost 7 years now that I’ve started my dividend investing journey and bought my first dividend stocks of my portfolio at Consorsbank. Actually, I’ve started on the 1st of February 2018 with three stocks. Disney, Apple and AT&T were my first three stocks for which I’ve created a saving plan and which were executed the first time in February 2018.

It took me some time to really start buying at the stock market at all. I’ve read a lot of books about financial freedom or how to buy stocks. Before I’ve invested my first money, I was more afraid of loosing my hard earned bucks and was scared of doing something wrong. Key words like WKN, ISIN, S&P 500, Nasdaq and many others were clear in theory, but in practice it was really scary.

On 13.06.2018, after 3 months of saving plan executions, I’ve bought my first stock directly. Realty Income ($O) was the company. 22 shares for 1018 € was my investment. I have read several articles about Realty Income and that it is one of the companies that increased their dividends over the last 22 years. In the meanwhile, Realty Income is one of the dividend aristocrats, which meant that they have increased their dividend payout at least over the last 25 years (29 years actually).

And there is a nice fact about Realty Income. In the past 7 years, this company paid me as of now 978 € in dividends. So my very first 22 shares of $O are already back in my pocket.

Going forward!

In the past years, my dividend investing journey evolved, corona crisis hit the world, I’ve become 30 years old, I’ve met my beautiful wife and became a father. I am happy to share in this post my experience and mistakes, but also what I am going to write about in the future. There are several psychological thoughts which came to my mind which I also would like to write about.

Why I Started Dividend Investing

In my about page, I am mentioning some of the reasons why I started my dividend investing journey and describing my personal goals for the next years.

I’ve read a lot about financial freedom and the overall goal to earn enough passive income which covers my expenses.

For sure there are several ways to earn passive income. Some of them I’ve described in my blog post 5 Ideas How To Earn Passive Income in Germany

My personal financial situation did not allow me to buy my own real estate properties to earn passive income from rentals. There is and was not enough equity to proceed in this direction.

In 2018 I’ve decided, keeping in consideration my personal situation and my personal goals, that dividend paying stocks will be my way to earn passive income. Over the last years, I’ve tried and used several other ways to make some returns, like real estate crowdfunding or P2P loans, but at the end, my focus was always on dividend investing and I will keep it there. It will be a long ride, but it will be worth it. It is crazy to see what I’ve reached in the last 7 years in terms of dividend income. In the next section I will provide some information about it and show you that you can do it as well! It also makes me curious to see how it will evolve over the next 7 years, If I can continue in the same way.

The dividend strategy is for people who want to earn passive income and grow their portfolio until retirement to live then from dividends.

My Dividend Investing Strategy: How It Evolved Over Time

My dividend investing journey started first with a question and then resulted in a strategy. The very first question I’ve asked myself – do I want to buy stocks from single companies or do I want to avoid single companies and buy one or more ETFs?

For my dividend strategy I’ve decided to buy stocks from single companies. You will see that I have now also a dividend ETF, but more to this point at a later time.

The reason why I chose single companies is simple. I wanted to learn more about analyzing balance sheets and how a company is performing, and I have fun doing it. I also enjoy keep checking if my portfolio is in balance or if there is a need of an action.

My First Strategy

So knowing that I want to buy single stocks, my first strategy resulted in a few key points:

- Buy only dividend stocks that fulfill some specific criteria

- Create a dividend calendar to make sure that a dividend payment comes in every month for the whole year

- Automate as much as possible to pay myself first and to avoid making mistakes

- Setup saving plans with a minimum of 30€ per company (Consorsbank allows saving plans for companies, not only for ETFs)

You can read more about this in my post: A Beginner‘s Guide To Build Your Dividend Portfolio.

All started very well. With about 10 saving plans I slept good at night and I kept investing my money more and more. In my first year of my dividend investing journey (2018) I’ve made 48 € in dividends for the full year. 2019 it was already 439 €.

Looking at my dividends in 2023, I must be honest that I am very proud about the persistence I’ve kept in the past years. There were times, when I was not sure anymore if it is the right way and If I am on track. Especially during the Covid pandemic there have been several sleepless nights. I am sure I am not the only one who was scared about all the money which we could have lost. In the section below, I will explain more in detail my situation during March-April 2020.

Coming back to my dividends of 2023 – I’ve reached 3011 €. It is an average earning of 250 € per month. At the moment I invest in 28 saving plans. It is a wonderful feeling to know that over time I will keep growing my dividend income!

What changed and what will change over time?

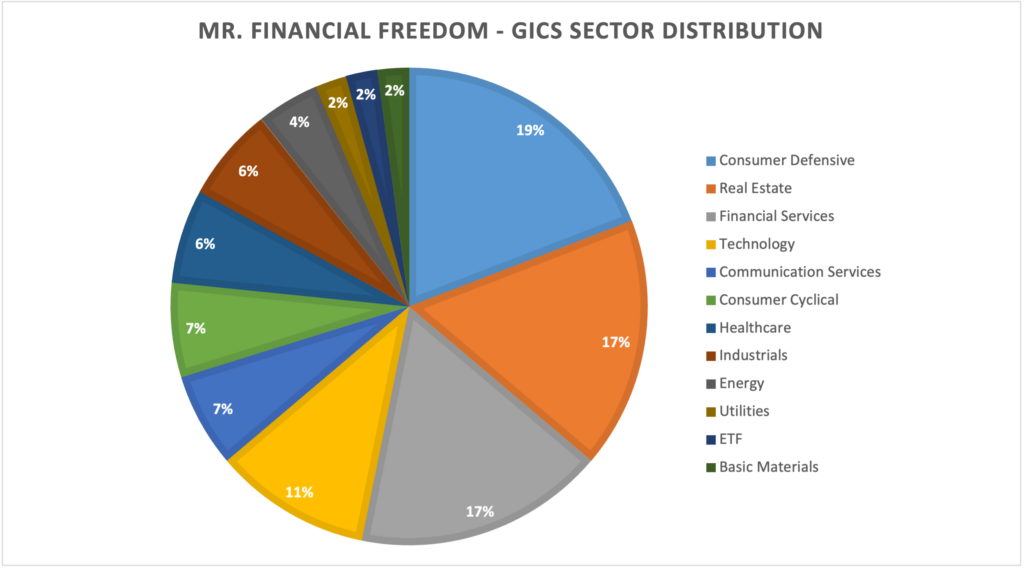

You have seen my strategy above. Over the time, I recognized it was too simple and did not have any focus on portfolio diversification in terms of stock sectors or country distribution.

Most of the companies in my portfolio are located in the United States and my distribution is not well balanced yet.

It is working out, but I need to take action to sleep better and to mitigate the risk.

Below you can see my current situation:

Mr. Financial Freedom – GICS Stock Sectors

Mr. Financial Freedom – Country Distribution

In the past year, I have been working on my portfolio diversification step by step. It is a slow process, as it depends also on my available cash to buy new stocks, of course.

But now you can imagine why I have added one ETF into my portfolio – for a better distribution.

I’ve analyzed 12 Distributing ETF’s and have decided for the following:

- Name: Deka Euro iSTOXX ex Fin Dividend Plus UCITS ETF

- Distribution policy: Distributing

- TER: 0,30 %

- WKN: ETFL48

- Fund size: 338 Mio

- Replication: Full Replication

- Holdings: 50

- Distribution (Top 4): Germany 20%, France 20%, Spain 18%, Finland 16%

It was important that the TER is below 0,50 % and that there is no USA involved. As you can see, I have a lot of US companies already in my portfolio. In the next months, the work needs to continue in this direction of diversifying my portfolio.

Mistakes I Made Along the Way

The missing sector and country distribution was for sure one of my mistakes. There was fortunately no negative impact so far, but mitigating the risk of having stocks from different countries and a proper sector distribution will be for sure a move in the right direction.

In the first section, I’ve mentioned that getting financial free in this way, will be a long ride and will take time. It is something I have accepted and I am confident that it is the right way. Nevertheless, there were many situations, where I took risks to gain fast returns.

Just to mention some situations:

- Invest money in stocks, who don’t pay dividends (not fitting into my strategy), but a gambling chance of fast returns (because someone said so).

- Do Option trading during earning announcements to gamble if the stock goes up or down.

- Buy stocks of companies who suffered a lot (price went down) and gamble on a good return.

You see I’ve used the word “gamble” in all of the situations. Just because it is gambling and loosing some money makes you more aware about it.

Wins and Strategies That Worked Well

I am not financial free yet, so I cannot tell you about my wins and strategies in my dividend investing journey which brought me to financial freedom. But I’d like to think that starting to invest at all and staying consistent to your plan, even with a little amount of money will be the key to my success. My saving plans which are executed without my manual intervention and investing on monthly basis feels right and I can see the growth in my dividend portfolio and income. Get started and keep going!

Looking Forward: My Dividend Investing Goals for the Future

The ultimate goal of my dividend investing journey is clear. Becoming financially free. It means to me, to have enough money available every month to cover my expenses without the necessity to go to work every day. With that goal in mind, it was key to me knowing when I can reach it. There are several ways to understand how much money you need to start your early retirement.

I call it my happiness number. Or in other words, the amount of money you really need to lead your life in the way you want to, where you still can work, but you don’t need to work anymore to cover your expenses. It is different for everyone, depending on your living standard.

My short term next goal is to earn a passive income of 1000€ per month which will cover part of our rent and expenses. Beside that I keep working on diversifying my portfolio as mentioned above.

How to calculate your happiness number? Read about it in my blog post:

Balancing Dividend Investing with Personal Health and Well-being

Beside following my dividend investing journey, I’ve kept thinking over the last year about other more important topics in my life. I don’t know the reason for it, maybe it is because I’ve become 30 years old and started my own little happy family. But one big thing which scares me a bit and directly keeps motivating me is my “health”. I am afraid of bad diseases in general. Being financial free, but sick, will give me nothing at the end. Reading about that topics, there is so much I can do for myself to prevent becoming sick.

It is my lifestyle, how I eat and drink, how many times I do sports per week and so much more. I’ve noticed that the same principles that guide investing—balance, consistency, and a focus on the future also apply to health and well-being.

Yet, there have been times when I got so focused on growing my portfolio that I neglected my own well-being. Skipping workouts, eating poorly, or letting stress pile up—these habits don’t just take a toll in the moment, they also rob you of the future you’re working so hard to build.

That’s why I’ve decided to expand the focus of this blog to include health and well-being topics. I want to share what I’m learning about living a balanced life because I believe true freedom comes from having both financial security and a strong, healthy body and mind.

Ending Thoughts

I love my current life and what I have reached until now and wouldn’t change my life for anything in the world. I will keep working on my portfolio and living a healthy life. In the next years I’d like to help others to start investing their money in the stock market and tell them about my experiences. I will make more mistakes over the next decades, but I truly believe I will learn from them.

Keep calm and earn dividends with a healthy lifestyle!

Mr. Financial Freedom

Latest posts by Mr. Financial Freedom (see all)

- The 24 Days of Wealthy Wonders 🎄 - December 2, 2024

- 7 Years of Dividend Investing: My Journey, Lessons, and Future Goals - November 17, 2024

- Should You Have A Shared Account With Your Partner? - June 16, 2022

- Do You Need 1 Million To Retire? - June 15, 2022

- My First Experience With Options Trading - October 29, 2020